Trading Position

In this article we gonna learn about Trading Position in trading.

There are 2 trading position to make profit or loss:

- Long Position.

- Short Position.

Long Position

A long position is simply the purchase of a stock or any other security in anticipation that its price will rise. The overall objective is to buy the stock at a low price and sell it for more than you paid.

The difference represents your profit.

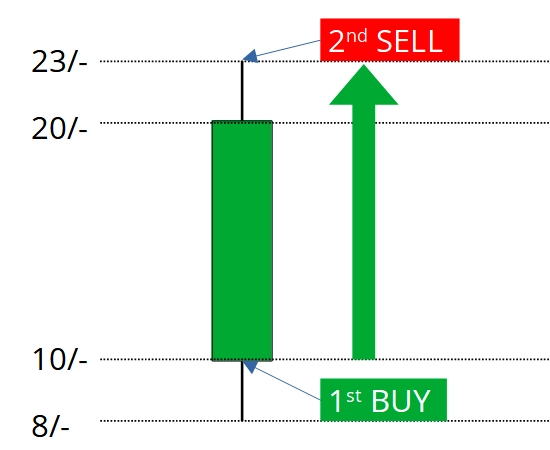

Long Position (Profit Scenario)

Profit in Long Position:

Buy the stock at a low price and

Sell it for more than you paid.

Sell – Buy = Profit

23 – 10 = 13/-

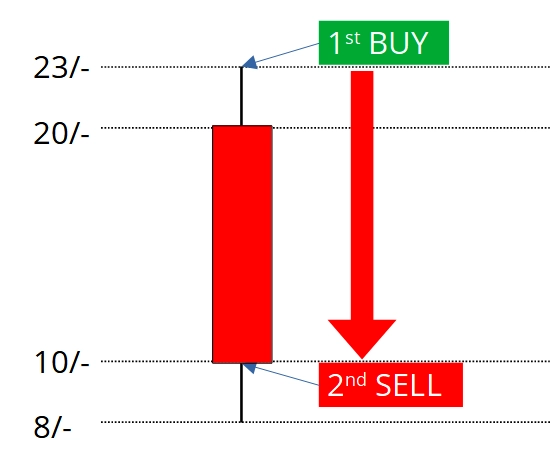

Long Position (Loss Scenario)

Loss in Long Position:

Buy the stock at a low price and

Sell it for more than you paid.

Sell – Buy = Profit

10 – 23 = -13/-

Short Position

Taking a short position, also called short selling, occurs when you borrow shares and sell them in anticipation the stock will fall in the future.

If it works as planned and the share price drops, you buy those shares at the lower price to cover the short position and make a profit on the difference.

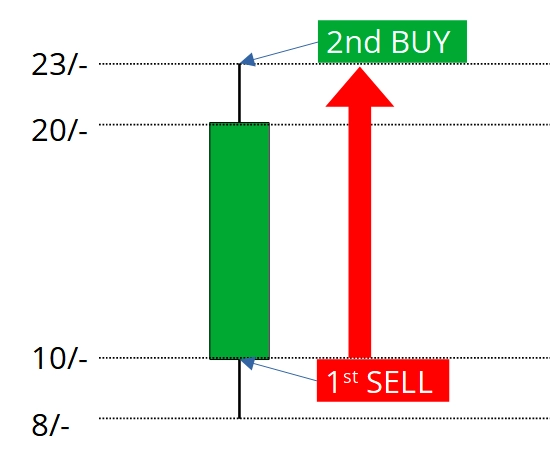

Short Position (Profit Scenario)

Profit in Short Position:

Sell the stock at a high price and

Buy it back for less price.

Sell – Buy = Profit

23 – 10 = 13/-

Short Position (Loss Scenario)

Loss in Short Position:

Sell the stock at a high price and

Buy it back for less price.

Sell – Buy = Profit

10 – 23 = -13/-

That’s it for Trading Position hope this article has helped new traders the Short Position in simplified method. In next article we gonna explore Price.