Types of Orders

In this article we are going to take a look at Types of Orders which is how you enter the market.

Order Product Types

- Intraday (MIS/Trading/Trade)

- Delivery (CNC/Investing/Invest/Long-term/Overnight/NRML)

Intraday (MIS/Trading/Trade)

- Trade using MIS/Trading/Trade for additional leverage/margin.

- All MIS positions auto-squared off 10 to 15 minutes before close of markets or when losses exceed 50% of margin (Auto-square off rule can vary based on market conditions).

Delivery (CNC/Investing/Invest/Long-term/Overnight/NRML)

- For intraday/overnight F&O trades without additional leverage.

- Exchange stipulated margins, positions taken as NRML can be held until expiry, provided required margins maintained.

Types of Orders

- Market (MKT) Order

- Limit (LMT) Order

- Stoploss (SL) Order

- Take Profit

Market (MKT) Order

An order placed to be bought or sold at the best available price.

Limit (LMT) Order

In limit order, you tell your broker you don’t want the market price (the current price at which a stock is trading); instead, you want your order to be executed when the stock price matches a price that you specify. An order placed to buy or sell at a predetermined price.

Stoploss (SL) Order

Stoploss if placing a predetermined loss booking order at a trigger price.

(Trigger if using this type of order to enter a fresh buy above the current market price or sell below the current market price when the trigger price is hit.)

Take Profit

An limit order that specifies the exact price at which to close out an open position for a profit.

Trading Scenario

Lets take a look at trading scenario on how to use different orders for e.g. Hypothetically you want to trade YSTC stock and will explorer both scenario i.e. Long and Short Position.

Long Position

The YSTC stock is trading at ₹ 14 and your analysis has made you bullish on this stock so you prepared your target at ₹ 20 and stop loss at ₹ 12 according to your market analysis with 10 quantity.

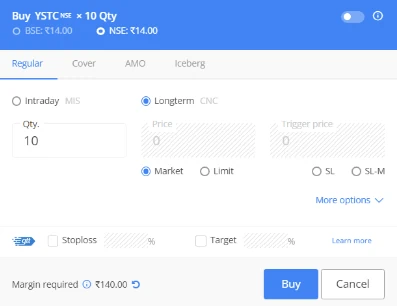

For Long position will open buying window and will enter with market order cuz we don’t want to miss the trade. See the image below.

As in the image we selected Longterm CNC and entered 10 in Qty. field with selecting the Market which makes our total investment ₹ 140. After checking we click buy. We get the following message.

In above image we can see that when we placed our order price was 14 and is executed at 15 which means our decision to go with market order was right. If we had taken Limit order then our order would remain as pending and we would be left out of market action.

One drawback of Market Order is that we didn’t get our order at our price instead of 14 we got 15 which makes our investment total at ₹ 150 instead of ₹ 140.

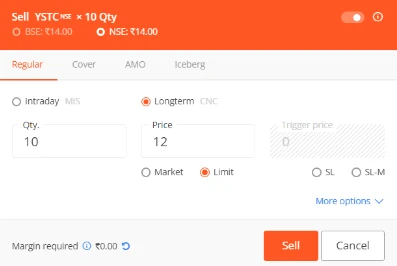

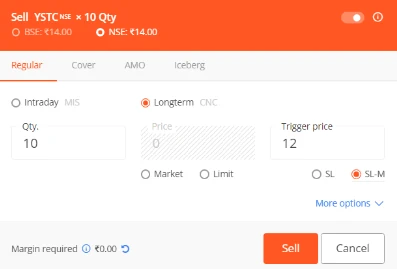

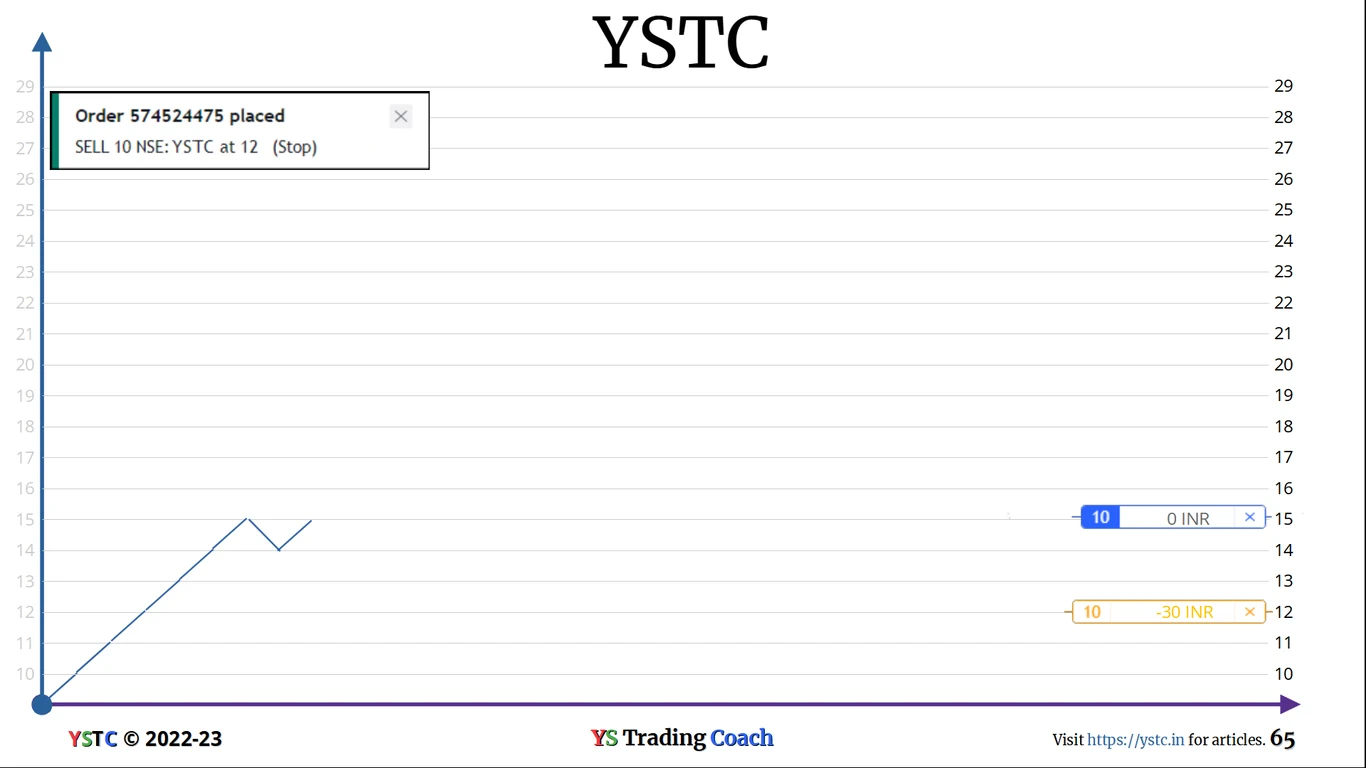

The first thing to do when anyone enters the market is to set Stop Loss. There are 3 types of SL orders Limit order, SL trigger order and SL MKT order.

Above is regular Limit order if price comes to ₹ 12 then this order is executed but the disadvantage is that some time a value can be skipped due to sudden movement.

This one is SL limit order main advantage of this over regular limit order is if you know how much skipping happens then can set it like that. Like in the above when price come to ₹ 12 order is triggered if the market skips ₹ 12 and goes to ₹ 11 it is executed i.e. if the 11 value is not skipped. This is better than regular order.

Next last one is SL-M (SL Mkt order) this should be the choice if your selected market skips SL Limit Order. In this order when price comes down to ₹ 12 then your order is sent as Market sell order. So it gets executed no mater what. The only downside of this order is instead of ₹ 12 it could get executed to even lower like ₹ 9 which will add up unnecessary losses. You have to personally try each orders stick to whichever is beneficial to you.

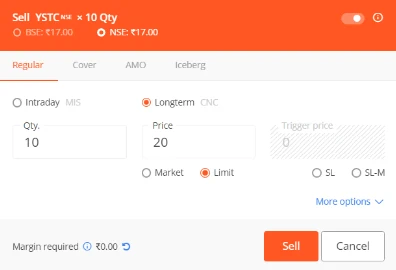

As our SL is placed we can see that if price comes down our loses will be ₹ 30 only. Our capital is protected. Now we place our target at ₹ 20 rupees.

Now either Target or SL will hit. Till then we can observe or do some other work.

As you can see above our target is hit and automatically the SL order should be canceled if not you have to manually cancel it. It depends on your broker’s platform.

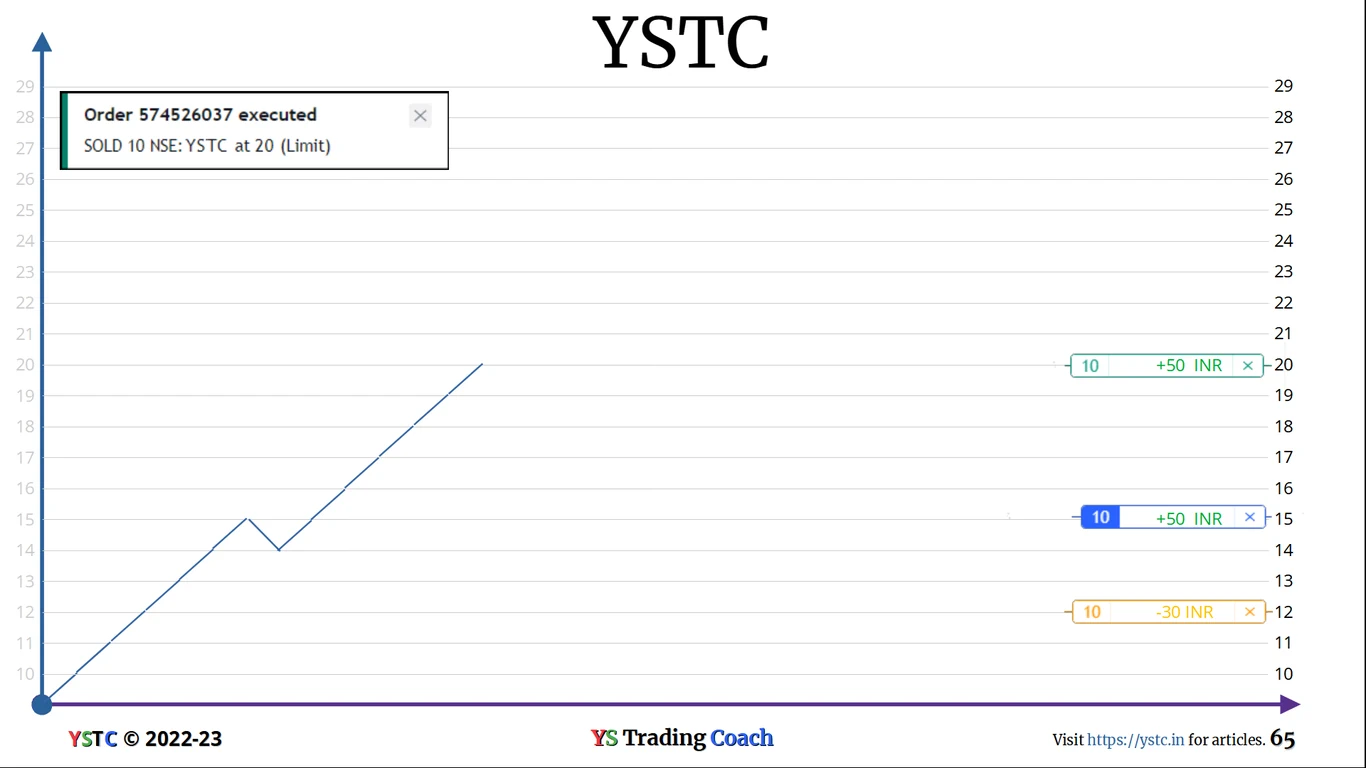

Short Position

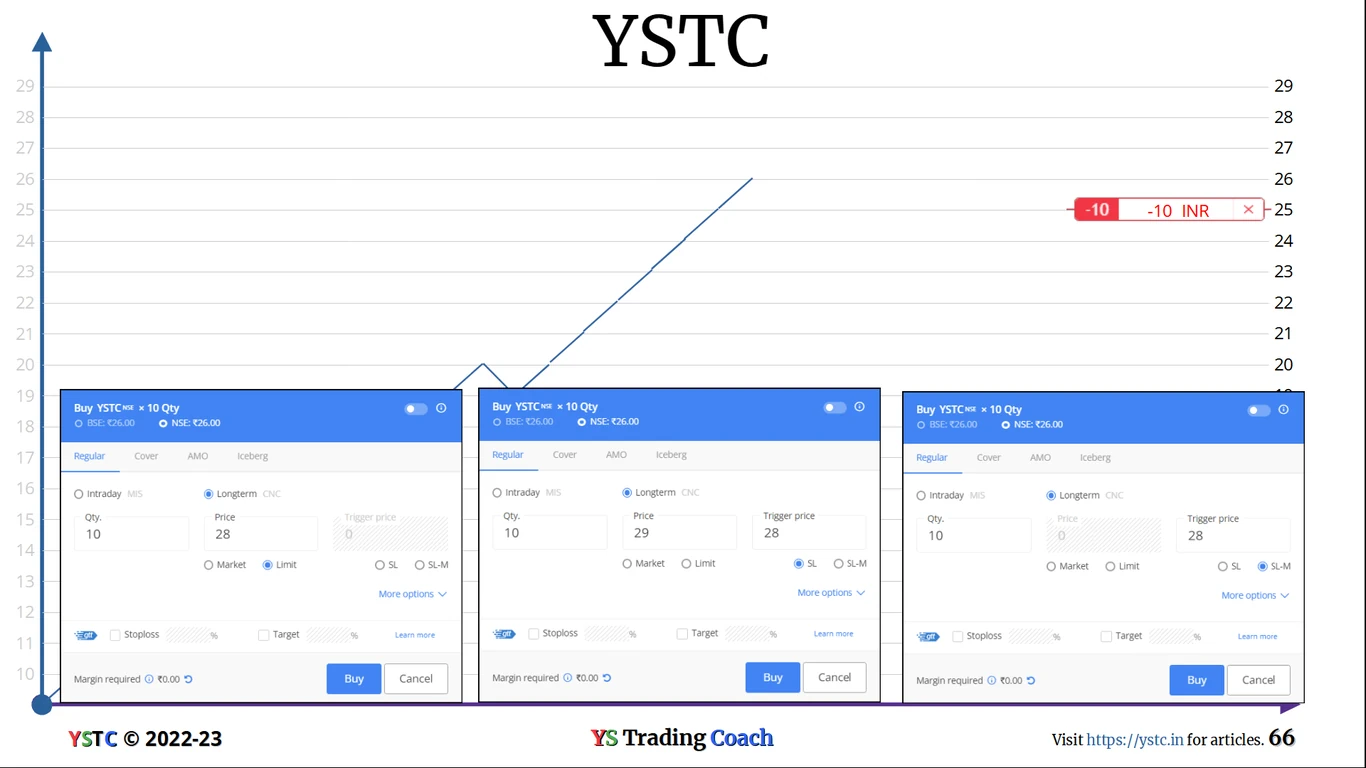

Our market analysis tells us that there is good shorting opportunity at ₹ 25. So we decide our SL at ₹ 28 and Target at ₹ 15.

In the Long Position example we entered through Market order. This time there is no need for market order as our price is yet to be reached. So we enter with Limit order of ₹ 25.

As our order is triggered we immediately set SL to ₹ 28.

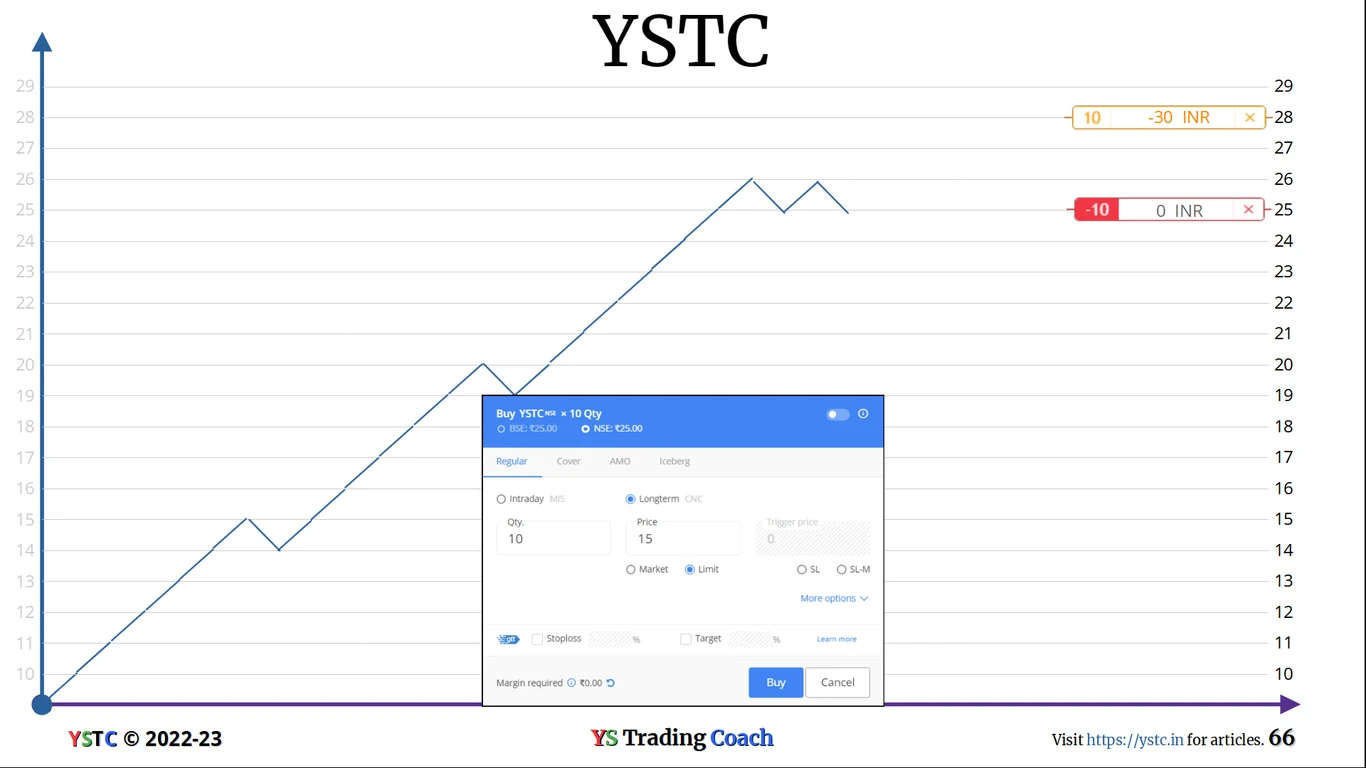

As we seen in SL in Long position the same applies here, any one of the SL order that suits you. After SL is set next is target at ₹ 15.

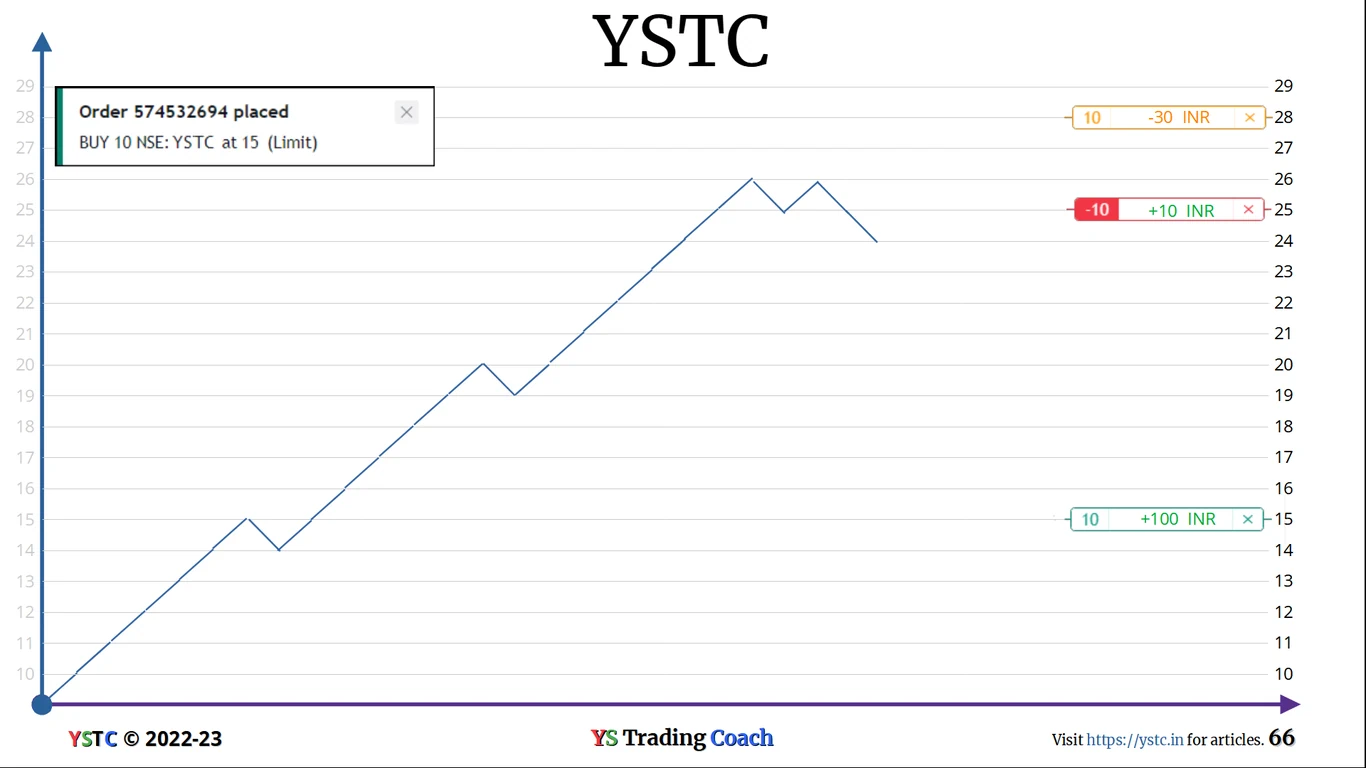

Target is set at ₹ 15 with limit order. After setting we wait for either SL or Target to Hit.

As you can see if we make loss it will be ₹ 30 and if profit ₹ 100.

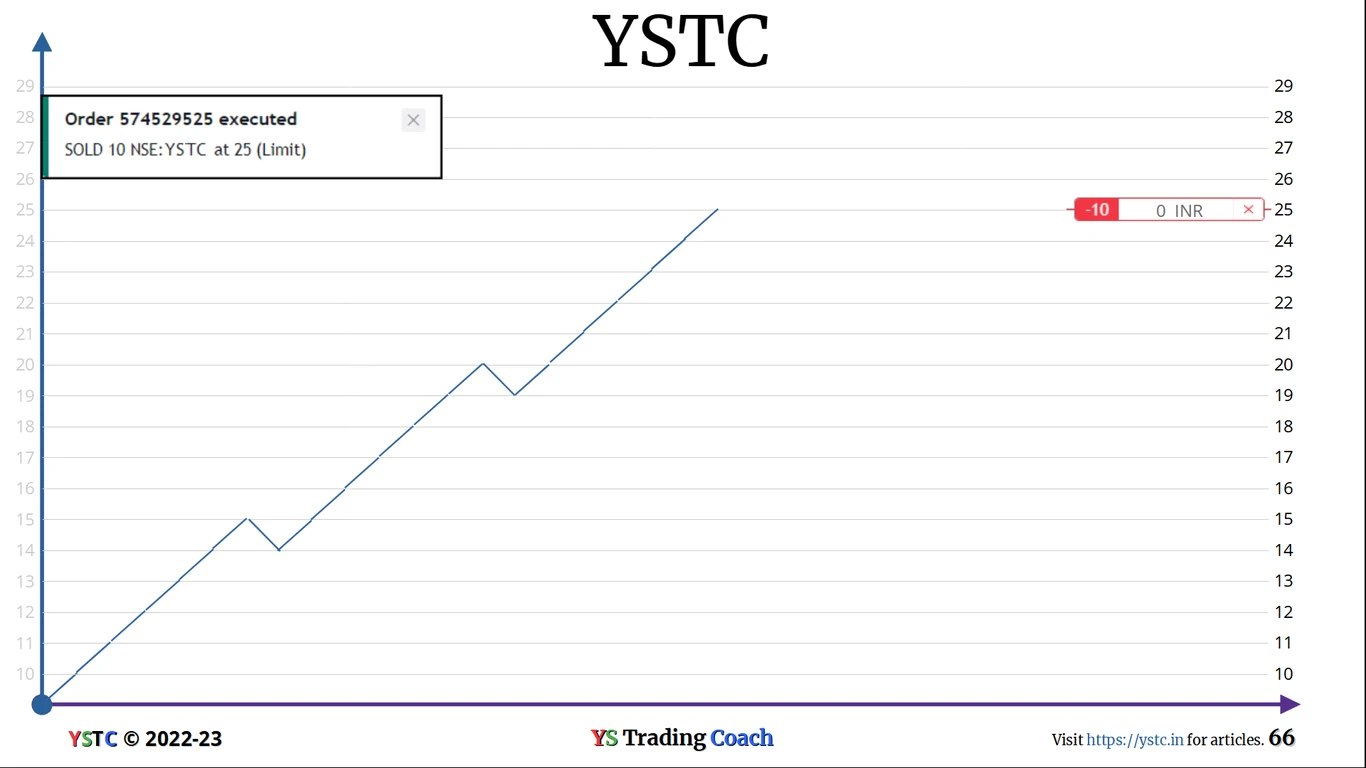

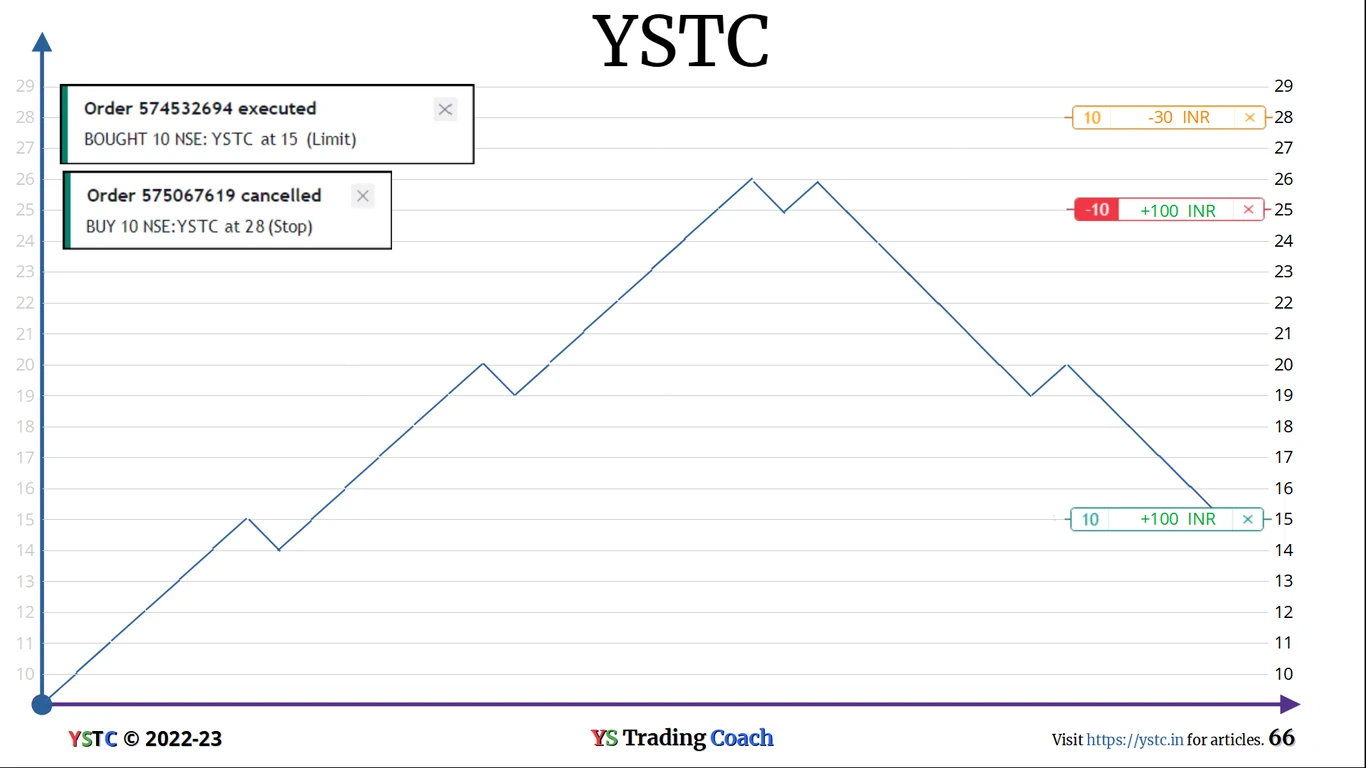

As you can see our target is achieved and SL automatically got canceled. Always be user to check if its canceled or not.

There are special case order types e.g. Iceberg order, After Market order etc. which are not shown but you can read the brokers documentation or call them.

Now that you know how the Market and Limit orders work we can now dive deep into The Dual Auction and see how prices really move, which orders make it move and why?